Insurance is one of the most important parts of property management, and one of the least clearly understood. Property managers are often expected to explain coverage to owners and tenants, navigate claims, and set requirements, all while juggling policies that were not designed to do the same job.

Tenant Legal Liability (TLL), renters insurance (HO4), and landlord insurance (DP3) each serve a distinct purpose. Understanding how they differ, and how they work together, helps property managers reduce confusion, manage risk more consistently, and set clearer expectations across their portfolios.

This article breaks down each policy in plain language and shows where each one fits.

The three core insurance policies in residential rentals

At a high level, residential insurance is split across three roles:

The property owner

The tenant

The property manager

No single policy covers all three as named insureds.

Tenant Legal Liability (TLL): Addressing tenant-caused damage

Tenant Legal Liability insurance is designed to address accidental damage caused by tenants to the rental unit itself. Unlike renters insurance, TLL is owned and administered by the property management company. The tenant is not an insured party, but their occupancy triggers coverage in accordance with policy terms.

TLL applies specifically to accidental tenant-caused property damage to the leased unit, such as certain types of fire, smoke, or water damage, subject to exclusions and conditions. It does not cover normal wear and tear, maintenance issues, or intentional or criminal acts.

When renters insurance is in force, it is typically primary. TLL commonly responds as excess coverage for landlord property damage. Property managers often use TLL to bring more structure and consistency to how tenant-caused damage is handled across a portfolio, particularly when tenant-maintained insurance varies or lapses.

HO4 Renters Insurance: Protecting the tenant

HO4 renters insurance is designed for tenants. Its purpose is to protect the tenant’s personal belongings and provide personal liability coverage.

This policy typically covers personal property such as furniture, clothing, and electronics, along with loss of use if the tenant is temporarily displaced due to a covered loss. It may also provide liability coverage if the tenant causes injury to someone else or damages another person’s property.

Renters insurance primarily covers a tenant’s personal property and liability. In some cases, a policy may include limited coverage related to the building or fixtures, but this varies by carrier and endorsement. Coverage for the structure itself is typically the landlord’s responsibility, so it’s important for tenants to review their policy carefully to understand what is — and is not — included.

DP3 Landlord Insurance: Protecting the property

DP3 insurance is designed for property owners who rent out residential properties, such as single-family homes, duplexes, or small multi-unit dwellings.

DP3 policies typically cover the dwelling, attached structures, landlord-owned personal property, and may include loss of rental income following a covered loss. They also may include liability coverage for injuries that occur on the property, depending on included endorsements.

Covered perils often include fire, wind, hail, vandalism, theft (if endorsed), and certain types of accidental water damage. Common exclusions include flooding, earthquakes, wear and tear, mold (unless endorsed), rodent or insect damage, and intentional acts. Also, this is the only of these 3 that may provide coverage when the unit is unoccupied.

DP3 insurance forms the foundation of protection for the physical property and is often required by lenders and ownership structures.

Side-by-Side Comparison

| Policy type | Who it's for | What it covers | What it does not cover | Who owns the policy |

|---|---|---|---|---|

| Tenant Legal Liability (TLL) | Property managers/owners | Accidental tenant-caused damage to the leased unit, subject to policy terms | Tenant belongings, wear and tear, intentional acts, bodily injury | Property management company |

| HO4 Renters Insurance | Tenants | Personal property, personal liability, loss of use | May or may not cover building structure, landlord property | Tenant |

| DP-3 Landlord Insurance | Property owners | Dwelling, other structures, landlord-owned property, liability, loss of rent | Tenant belongings, flood, wear and tear, tenant neglect | Property owner |

How these policies work together in practice

Rather than overlapping, these policies are designed to address different types of risk:

TLL helps address accidental tenant-caused damage at the unit level

DP3 protects the owner’s physical asset and liability exposure

HO4 protects the tenant’s belongings and personal liability

When aligned correctly, this structure helps reduce gaps, clarifies responsibility, and makes claims handling more predictable.

Why this matters for property managers

Insurance questions rarely arise at convenient times. They tend to surface after damage occurs, during disputes, or at move-out. Property managers who understand how these policies differ can respond with clarity instead of uncertainty.

Clear education also helps:

Set expectations with owners and tenants

Reduce confusion during claims

Create more consistent portfolio-level risk management

Tenant Legal Liability insurance represents one way property managers can structure coverage more intentionally, while renters and landlord policies continue to serve their established roles.

The goal isn’t more insurance. It’s better understanding.

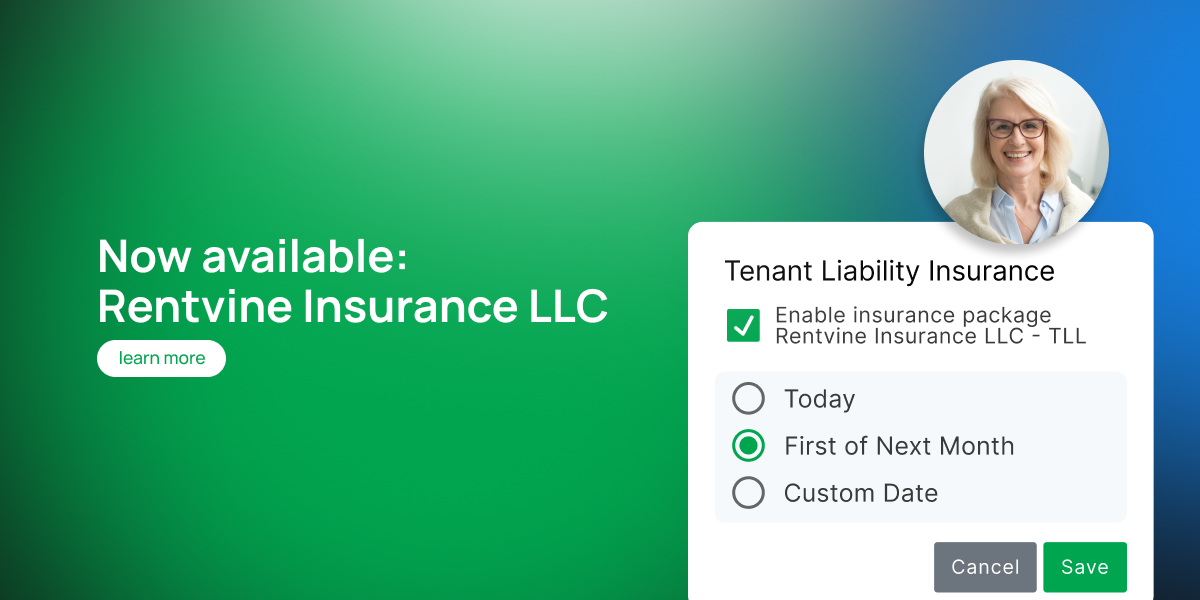

For information about Rentvine Insurance, learn more here.